When it comes time to sell it your multi-partner, million dollar plus accounting firm, because of its ‘size’, you will run into unique issues that smaller tax and accounting firms do not.

Fewer Potential Buyers To Sell To

Fewer Potential Buyers To Sell To

There are tens of thousands of tax and accounting firms in the US with gross revenue under $1,000,000 in revenue. As you move up that gross revenue ladder, there are fewer and fewer firms that are of similar or larger size than your firm.

Excuse the metaphor but because ‘larger fish like to eat smaller fish’ and not the other way around, your pool of potential buyers shrinks considerably. This means the sale will take more time and effort on our part, in order to find the right kind of buyer, qualify and negotiate with them on acquiring you.

Depending on your location (rural, small town, in or near a statistical metropolitan area – SMA) it could take upwards of 1 to 2 years to find the right suitor and close on an acquisition that is a good fit for you and the buyer.

More Scrutiny On Your Financials

More Scrutiny On Your Financials

Although some larger firms have the cash on hand to write a check for an acquisition of your size, virtually all of these firms will go to a bank and finance most of the purchase.

And although loan officers will tell you privately that they and the bank make more money the larger the loan, they also have more risk. Therefore their underwriting and credit people will analyze your firm’s financials harder than normal.

Because larger firms have more overhead and tend to be ‘less profitable’ than smaller firms, running a tight ship as the managing partner is a priority as you plan to sell the firm. Make sure expenses are in line, especially for the last 3 years of financials, and tax returns for the firm are available. Clean monthly financial reports so buyers and banks can look at cash flow throughout the calendar year will also help.

Offers With Lower Multiples of SDE or Cash Flow

Offers With Lower Multiples of SDE or Cash Flow

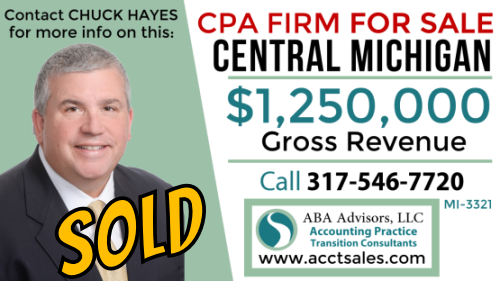

Depending on a variety of variables, smaller firms with gross revenue in the $250,000 to $1,000,000 range tend to sell in the 1.1 to 1.25 times gross revenue range.

Because of the previously discussed items, larger firms tend to know it is more of a ‘buyer’s market’ and make lower offers. That said these offers are also more complicated as the selling partners are often not homogeneous in their goals moving forward.

One might want to retire now. Another will stay on for 1-3 years and if there’s a 3rd partner, he or she might want to stick around for another decade. All these puzzle pieces are taken into account in larger firm acquisition offers.

Unforeseen Black Swan Events

Unforeseen Black Swan Events

As brokers we have and follow an organized process to match buyers with sellers, assist them with the due diligence process, facilitate bank financing for acquiring firms, as well as negotiate with attorneys involved in the process.

Still, Murphy’s Law is alive and well. Over the years we’ve run into these types of out-of-left-field & unexpected situations, some more than once. For example a buyer in the middle of due diligence is told by their spouse one weekend the spouse wants a divorce. Or the bank providing financing, on the day before closing finds they’ve written their own loan package incorrectly and needs to delay the closing. Or the buyer has a lawsuit that they were ‘unaware of’ that appears and spooks the lender just weeks before closing.

Fortunately because we’ve seen and experienced these situations before, we understand how to navigate through them. And although each one of these above situations was real (and plenty more we could tell you stories about), each was resolved and each of our clients were able to sail off into the sunset with a new owner at the helm.

‘Finis Origine Pendet’ – The End Depends On The Beginning

‘Finis Origine Pendet’ – The End Depends On The Beginning

When looking to sell your firm there are several options here in the US. There are accounting practice brokers that boast of of $1.5 Billion in deals closed (sounds like McDonald’s ‘billions served’ tagline).

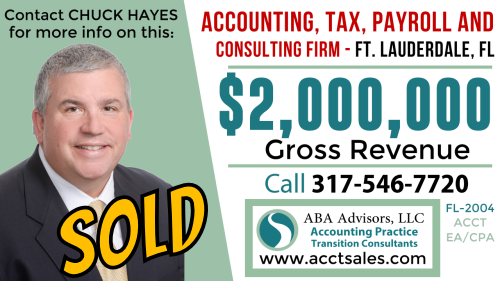

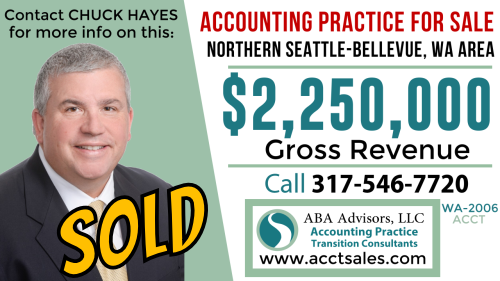

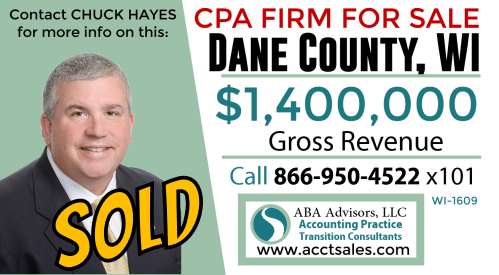

And there are slightly smaller brokers like us here at ABA Advisors, that have the time & bandwidth to be more focused on working personally with our sellers to successfully navigate through the sometimes complex process of selling their larger firm to the right buyer.

Hopefully you only sell your multiple-partner accounting practice firm ONCE in your career. And because in life more often that not, ‘the end does depend on the beginning’, we suggest talking with us first before you sign any listing agreement that the other ‘billions closed’ business brokers. We’ll explain our process, what the current market conditions are and what you can expect from us when we list and sell your firm.

Thinking About Selling Your Firm in 2024 or 2025 and Beyond?

Call us at 317-546-7720 or our national number at 844-ABA-0001 (844-222-0001) or book a time using this link so we can answer your questions about selling your firm this year or in the next few years.

Call us at 317-546-7720 or our national number at 844-ABA-0001 (844-222-0001) or book a time using this link so we can answer your questions about selling your firm this year or in the next few years.

Because the lead time for selling larger firms is longer it is never too early to talk to us so we can help you plan ahead.

ATTEND OUR MONTHLY WEBINAR – Also on the first Wednesday of each month we host a live webinar / teleseminar ( NOT a Zoom call where your identity is shared ) where we discuss the process of selling your firm, share some examples or Case Studies of recently sold firms, and also answer any questions you have – live during the call.

To register for the webinar click here. You’ll be emailed login credentials and can join via the internet or by phone.

Thanks, Jeff Bell – Managing Director